The Worst Advice Amateur Investors Receive

In most industries, going to a professional is the smartest thing you could do. If you are sick, you seek a doctor’s advice. If you want great photographs, you hire a professional photographer. Similarly, some would suggest in the investing world, going to a professional is the only smart option. Buyer beware. Unfortunately, amateur investors are receive terrible advice from so called “professionals.” Even great advice, can turn bad if it’s not properly understood. Here is clarification on a few pieces of advice.

Mutual fund managers can outperform amateur investors because they have more resources / time.

This assumption begins with the idea that mutual fund managers can outperform individuals when picking individual stocks. The problem is actively managed funds have a problem outperforming index funds, never mind individual investors. According to various studies, index funds outperform actively managed funds by between 60% and 90% of the time.

Even Warren Buffett disagrees with the idea that professional managers can outperform individuals. The focus on short-term performance puts fund managers at a disadvantage as they feel compelled to take chances. Buffett says, “You don’t have to swing at everything, you can wait for your pitch. The problem when you’re a money manager is that your fans keep yelling “Swing you bum!” Individuals can choose to focus on their best ideas, buy and sell as they please.

Have $10,000 to invest? Buy an index mutual fund.

If you are going to invest on your own, shouldn’t you want to outperform the averages? Professionals say investing a low cost index fund is a way to begin building your portfolio. Some even go as far as to say, “it’s often a better idea to start with a diversified portfolio…than trying to pick winners.“

Index funds seem to have an advantage over actively managed funds. However, individuals have numerous advantages versus mutual funds. Individuals can hold a significant percentage of their portfolio in a handful of stocks. In addition, individuals can control the tax implications of their investments, by choosing when to buy and sell. Last, individuals have knowledge of industries they work in, that may exceed the expertise of mutual fund managers.

100 minus your age = the percentage of your portfolio in stocks.

A popular piece of terrible advice, is that if you subtract your age from 100, you arrive at the percent of stocks you should hold in your portfolio. Unfortunately, there are two significant challenges to this theory. First, life expectancies have been rising. In the U.S. in the 1981-1985 timeframe, the average life expectancy was 74 years. A recent study suggested 2015 U.S. life expectancy has risen to 79 years. This may not sound like a lot, but five additional years of spending can be the difference between enough money to retire, and not enough.

The second issue is this formula assumes that when you are younger the market will outperform. Unfortunately, there have been ten year periods where the return on the S&P was actually negative. If you put 70% or 80% of your portfolio into the market at the beginning of one of these challenging decades, you could be behind the proverbial eight ball. A better formula might be to change the types of stocks as the person ages. Younger investors can afford to buy riskier stocks and take more chances. An older investor might focus on safer industries, and dividend paying stocks.

Chase a hot sector.

Amateur investors often get taken by the idea that if they just chase the hot sector they will do well. A recent article suggested that individuals may do well by picking stocks from sectors that have performed well at the end of bull markets.

The idea of chasing a hot sector isn’t new. Investors in 2000, believed that anything with .com in the name would make billions. Unfortunately, as reality set it, tons of companies disappeared along with their stock value. These same investors believed in 2006, that the real estate market would rise by 20% a year forever.

Amateur investors can fight this terrible advice by ignoring it completely. Looking for companies with a competitive advantage, and investing regardless of what industry they belong to is a far better strategy.

Never lose money.

Even world famous investment advice can be mis-construed into bad advice. One of Warren Buffett’s most famous pieces of advice is, “never lose money.” Unfortunately, this great advice (based on thorough research of a company) has been transformed into “sell if you’re down 10%” or “use stop loss orders to limit your potential losses. Some financial sites even suggest that an, “investment strategy must have built in safe-guards.”

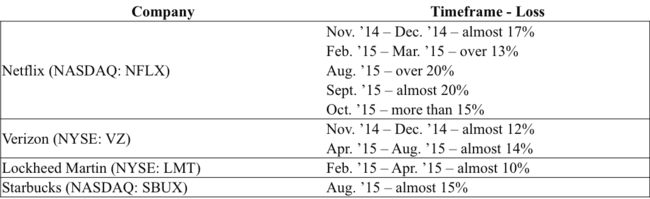

This might be the worst advice in the market today. Let’s take a quick look at a few companies and how many times you would have sold them assuming a 10% stop loss order.

As you can see, regardless of size, industry, and growth, fantastic companies can lose more than 10% on a regular basis.

The bottom line. Amateur investors have to be careful about the advice they listen to. Instavest can provide amateur investors with insight from lead investors. Investing doesn’t have to be complicated: do some research, buy what you understand, and watch your trading costs (only $3.49 commissions when you sign up for a brokerage through Instavest). Going to a professional makes sense in most cases. However, when it comes to investing, tuning out the bad advice might be the most important thing an amateur can do.

Haven’t heard of Instavest? We enable investors to find the world’s best investments. Sign up today to access high quality research and partner with great investors!