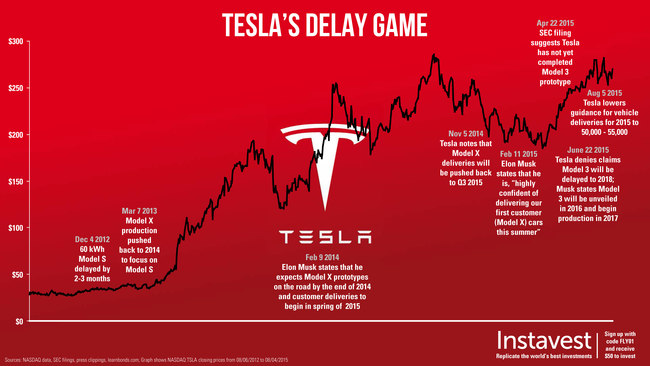

Infographic: Tesla’s Delay Game

Yesterday, Tesla [(NASDAQ:TSLA)]([https://www.google.com/finance?q=NASDAQ:TSLA) reported earnings for Q2 2015. Tesla beat revenue and earnings estimates of -$1.17 billion (non-GAAP loss per share of $0.60) by posting results non-GAAP revenue of -$1.20 Billion (non-GAAP loss per share of $0.48 cent). That’s approximately triple the loss of Q2 2014, fueled by the company’s aggressive growth initiatives and spending around the oft-delayed Model X and the Nevada battery factory, which the company hopes to open in 2016.

Additionally, Tesla lowered its guidance on vehicle sales for this year. The original estimates were put at 55,000 Model S and Model X deliveries for 2015. Yesterday, that number was cautiously lowered to 50,000 to 55,000 total cars, adding that gross margin may decline. Consumers are still waiting for the first Model X delivery, which has been multiple times since its...